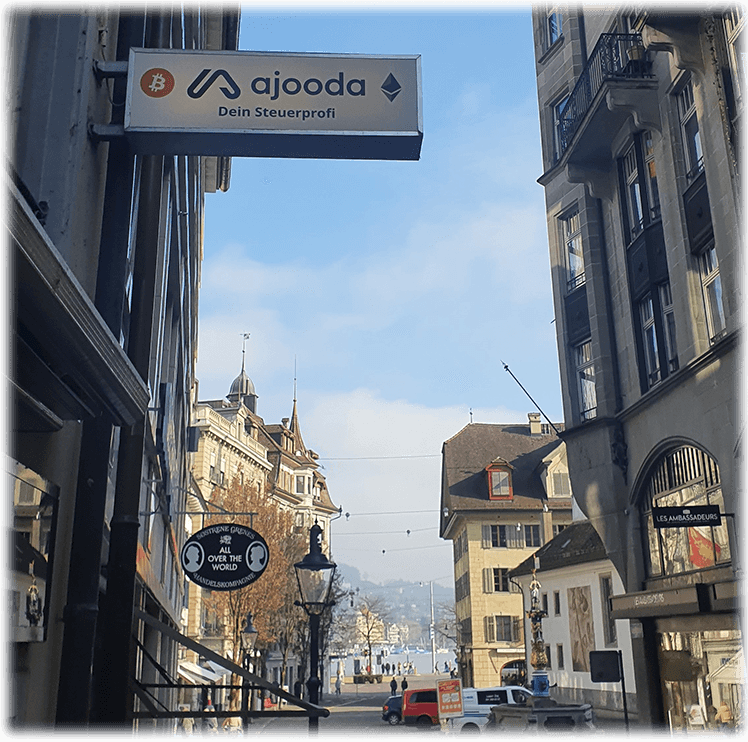

Get the most comprehensive advice in Switzerland now with ajooda, your specialized financial and tax advisor.

If the idea of settling in Switzerland is more than just a consideration for you, then you likely understand the significance of having access to reliable, objective, and personalized information.

Switzerland is renowned for its high quality of life but also has a intricate tax landscape that varies not only between cantons but also among municipalities.

A comprehensive analysis of the crucial factors that can assist you in making an informed decision about a potential move to Switzerland. Some of these factors include:

Your individual situation is always considered for the detailed analysis (number of children, income, real estate, stocks and dividends, etc.).

Our fee for this comprehensive analysis and consultation starts at CHF 5’000. You can request additional services as well.

Income tax: How is your income taxed in Switzerland? What deductions are possible?

Wealth tax: Switzerland is one of the few countries that levy a wealth tax. How does this affect your assets?

Inheritance and gift taxes: These taxes vary greatly between cantons. We provide you with a clear overview.

Capital gains tax and dividend tax: What attractive advantages do you have in Switzerland if you hold shares and how much dividend tax is due?

Real Estate Transfer Tax & Real Estate Profit Tax: Holding real estate is always associated with taxes, we show you what has to be considered in Switzerland.

Housing costs: From rent to utilities.

Insurances: Which insurances are mandatory, which are optional?

Services and leisure: From gym membership fees to restaurant visits – we cover all aspects.

We will find the suitable property/s for you. Whether for private living or as an investment property.

Thanks to its political and economic stability, Switzerland offers excellent opportunities for asset protection.

Every region in Switzerland has its own peculiarities, including tax rates, deductions, and surcharges, which we’ll shed light on.

Our experts are available for a three-hour in-depth consultation.

Experience and expertise: Our team consists of financial experts and tax advisors with decades of experience in the Swiss financial and legal system.

Individual advice: No two clients are the same. That is why we aim to provide you with comprehensive and individual advice.

Data basis: Our analyses are based on current data that is updated on an ongoing basis.

Legal security: Switzerland is known worldwide for its legal security, which makes it an ideal place for long-term life and financial planning.

Multilingualism: We offer our services in 5 languages, just ask us.

It is an important decision to move the center of your life to another country. With ajooda at your side, you make this decision on a sound, data-based foundation.

Contact us now and take the first step towards a financially secure and quality life in Switzerland.