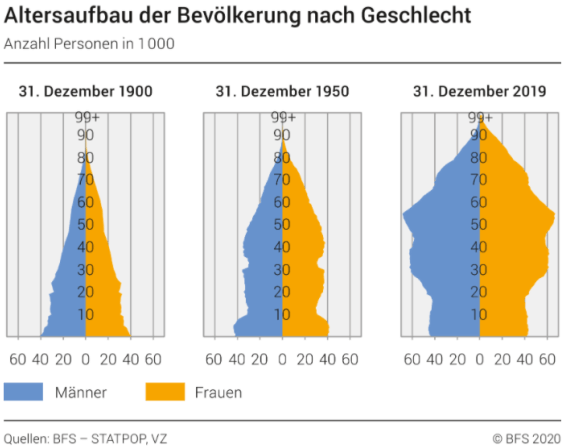

No 25 year old today can hope for a pension in 40 years.

The AHV has already been under severe pressure for several decades and will no longer be able to pay pensioners a pension.

The Swiss government therefore promotes the 3rd pillar pension and allows to save up to CHF 2’500 in taxes per year.

With an average interest rate of 8% per year, it is even possible to retire early than you thought.

The government itself is aware of the AVH and pension fund problem and therefore offers huge tax savings to those that open a Pillar 3a.

The total amount paid in the Pillar 3a can be deducted from income tax up to a certain limit: CHF 6’883/year for employees and CHF 34’416/year for persons who are not covered by the pension fund (self-employed).

Depending on the canton and municipality, this results in an annual tax saving of CHF 1,000-2,500.

How big are the tax savings in your municipality? Ask us!

Following example:

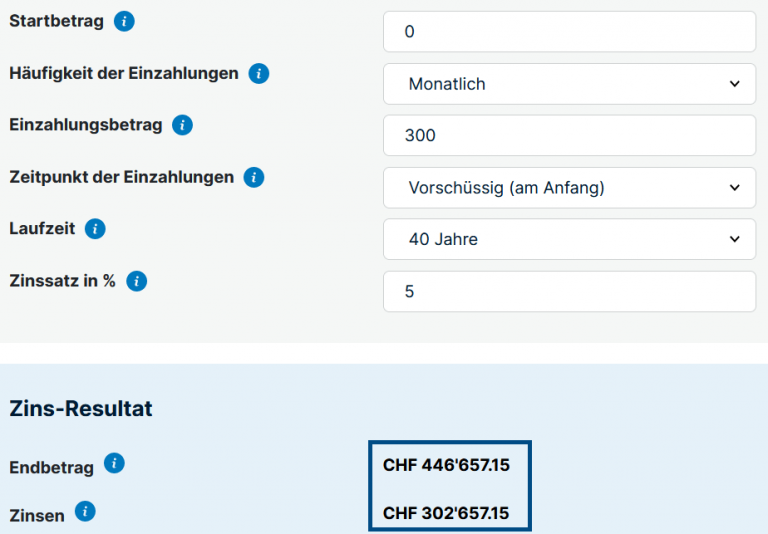

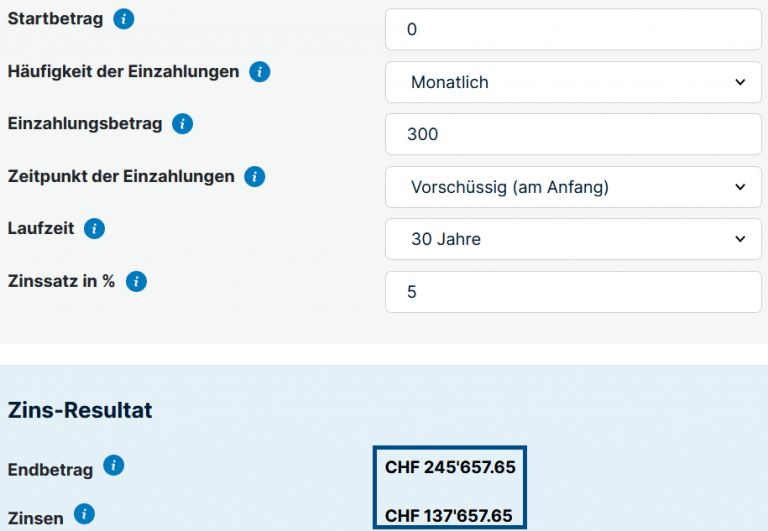

We have two young men and both put CHF 300 per month into their 3rd pillar.

Let’s assume an average interest rate of only 5% per year.

Since Karl is missing 10 years, his retirement capital is a massive CHF 200’000 lower!

His interest income amounts to only CHF 137’657 and is thus not even half as large as Jonas’ hefty return of CHF 302’657.

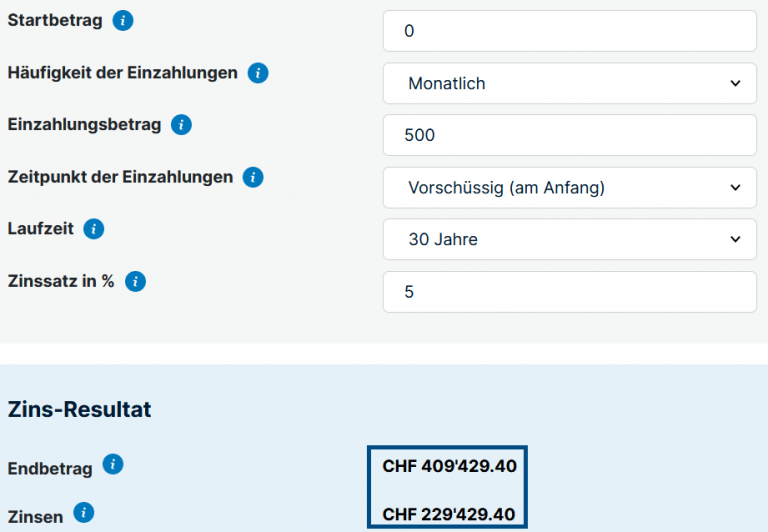

Karl earns well and therefore decides to start with CHF 500/month instead of only CHF 300.

Although Karl contributes CHF 200 more per month than Jonas, he does not catch up with him. He is still missing almost CHF 40’000!

This is because Karl was not able to take advantage of the compound interest effect early enough and was only able to earn CHF 229’429 by paying interest.

A whole CHF 73’228 less, although he contributed more than Jonas the whole time.

Young people can forget about the AHV Pension.

Reasons:

It is no longer enough to rely solely on the state pension scheme.

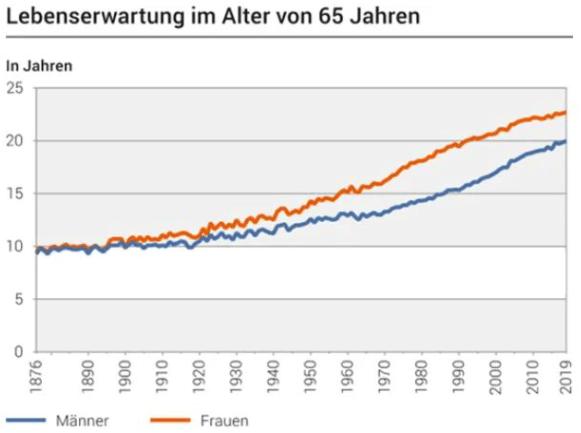

Even those who will retire in the next 10 years are in a much worse position than our ancestors who retired 20-30 years ago.

The 2nd pillar (occupational pension) is designed to secure the total income to approx. 60-70% of the previously earned income.

High earners have a particularly big problem: The 2nd pillar only applies to salaries up to CHF 86’040 (without BVG Überobligatorium).

From this, one must deduct the coordination deduction of CHF 25,095, which results in a maximum insured salary of CHF 60,945 (“coordinated salary”).

The conversion rate for the retirement pension is currently 6.8%.

This means that if you have, for example, CHF 100,000 in the pension fund, you will receive an annual pension of CHF 6,800 from the occupational pension plan.

When the BVG was introduced in 1985, the conversion rate was 7.2%. This value will continue to fall sharply, new reforms could now reduce it to 6%.

You can set up a 3a and 3b with a bank or with an insurance.

Both are quite suitable for pension planning.

Your bank will contact you when you have enough saved up and try to sell you their own product.

And indeed, it is better to save the money in the pillar 3a in the bank than in the savings account, because there it does not yield interest, and even possibly negative interest.

The banker will say that you are completely flexible and only have to pay in for retirement when you want.

However, when saving for retirement, the question arises:

Is it really an advantage that I only pay in when I feel like it?

Fun Fact: A Pillar 3a at the bank lasts on average only 2.5 years!

At the beginning you are motivated and with time you go on the overpriced cruise or get the new TV and forget about it with the precaution “Yes, I’ll do it later”.

Out of sight, out of mind – “later” usually never comes and you have to survive in retirement with less than CHF 3,000 (sometimes way less).

The 3rd pillar at the insurance is no longer as rigid as most people think.

In the past, you only had the choice of taking out a mixed life insurance policy in addition to the classic life insurance policy.

This meant that in the first 3 years, the majority of the premiums paid in were used for administration costs.

Today, you can invest in a investment fund 3a and have the money in the 3rd pillar from day one.

With 3rd pillar insurance, you can also pause payments if, for example, you would be unemployed for a longer period of time.

The great advantage of the 3rd pillar with insurance is that the savings goal is guaranteed to be achieved.

While with the bank you only benefit from the tax deduction and compound interest, with the insurance you have the additional advantage that your savings goal is protected should a risk event occur.

The 3 risks are:

Whether it is due to an accident or illness, it can affect anyone. If you are disabled, you are usually dependent on the IV and your income is severely restricted.

As an option, the insurance company will pay you a supplementary pension to the IV pension, also known as a disability pension.

At the beginning of the contract, the amount of this pension can be determined optionally. This is usually between CHF 1,000 and 2,000 per month.

Who continues to pay your monthly premiums if your income has dropped due to disability?

The bank?

No. Only the insurance company does.

The so-called premium exemption is always included and ensures that the insurance company takes over your premiums if you can no longer do so.

This way, the savings goal is achieved no matter what!

The risk of death must be covered, especially if you have a family with children.

This is because the gap is enormous if one parent or the main earner no longer exists.

It also makes sense to cover this risk if an indirect amortization of the mortgage through the 3rd pillar is active, because this way the property does not have to be sold in case of death.

By the way, the indirect amortization of a mortgage through the 3rd pillar is the smartest way to finance your mortgage.

Are you thinking of buying a house or an apartment, but don’t know exactly how to approach the financing?

We can help you, get in touch with our experts.

Yes absolutely!

There are 2 very important advantages:

If a person passes away, the descendants inherit his or her assets and debts.

If the deceased is so heavily indebted that the debt even exceeds the assets, the descendants must reject the inheritance in order not to have to bear the debt.

The capital in the 3rd pillar is paid out to the heirs even if they reject the inheritance due to over-indebtedness of the deceased!

If a person goes bankrupt, everything he has is pledged so that he can pay off his debts as best he can.

Everything can be pledged except your money in the 3rd pillar.

The capital you have in the 3rd pillar cannot be taken away from you and is protected against pledging.

So, you see, the third pillar has much more than just the advantage of having enough capital at retirement.

The 3rd pillar can be customized to your needs. You can also choose between different fund solutions.

Are you someone who wants to achieve higher returns and accepts a higher risk, or someone who plays it safe and prefers a conservative portfolio?

The investment strategy can also be modified later on.

We have been active in pension consulting since 2010 and have helped over 1’000 clients with their savings and pension planning.

Through our close cooperation with the largest Swiss banks and insurance companies, you get access to the best 3a investment funds.

We offer consultations in person or via Zoom/Microsoft Teams.

Your biggest advantage is our expertise in equity markets and funds. We know the Total Expense Ratios (TER) and Alpha returns of all funds in Switzerland.

Since retirement planning is a long-term thing, we want to make sure that you can save as much capital as possible for your (early-) retirement.

Over the last 10 years, we have been able to provide our clients with an average return of 8-10% net per year.

This a 250% gain of your money in 10 years.