One of the most frequent questions our financial experts receive daily from our readers is: “I want to invest in the stock market, where can I buy shares?

In the last decade, there have probably been only a handful of things that have gripped and fascinated the masses as much as the stock market and the stock market.

Even after the release of the film Wolf of Wallstreet, the fascination with the stock market and buying shares was catapulted to immeasurable proportions.

A world that used to be accessible only to financial professionals or the wealthy is now open to every citizen who wants to participate in the financial markets.

Some do it just for fun and curiosity, while others want to apply the financial knowledge they have learned, invest for the long term and thus build up their wealth.

Some opt for the active approach. This means day trading, swing trading, analysing shares, reading share valuations, studying analysts’ recommendations, etc.

The others like it more leisurely. They would rather build up an ETF portfolio and invest in ETFs.

Especially since 2020, more and more people have been asking themselves the following questions:

- Where can I buy shares?

- How can I buy ETFs?

- Where can I buy Bitcoin or invest in cryptocurrencies?

- How can I build up my assets?

Some did it out of boredom, others because they think they will become millionaires within a month or those who are aware that they will not receive enough pension in old age and are already taking precautions and building up their assets.

In Switzerland, the last group has the great advantage that they can build up assets through the 3rd pillar and also save an enormous amount of taxes.

Especially for young people, saving in Pillar 3a is extremely attractive and important. Because of the long investment horizon in the 3rd pillar, they can even cope with big crashes without any problems.

Where can I buy shares?

Nowadays you can buy shares very easily with the help of an online broker account.

It doesn’t matter whether you want to buy US shares, such as Apple shares, or whether you prefer to focus on domestic companies, such as Raiffeisen shares, the procedure is very simple:

You open an online broker account by verifying your identity with the provider of your choice and linking your bank account to the online broker account.

Now you can make deposits from your private bank account to your online broker account whenever you want.

You can now use the money in your Online Broker account as you wish and buy individual shares, ETFs, etc. When you sell shares, the money ends up in your account.

When you sell shares, the capital ends up back in your online broker account, not in your private account.

As shares are a very liquid asset class, you can sell shares very quickly (at a profit or loss, depending on the situation) and transfer the capital to your private bank account if you need it.

With which provider to buy shares in Switzerland?

In the meantime, there are providers like sand on the beach. Especially beginners do not have it so easy and quickly lose the overview.

However, this should not stop you from investing in shares, building up assets in the long term and securing a piece of financial freedom for you and your family.

We use some of these platforms ourselves. However, we do not have any paid partnerships and do not want to advertise here. We would just like to show you 4 popular options where you can buy shares in Switzerland.

The most popular online brokers in Switzerland are:

- Degiro

- Swissquote

- Interactive Brokers

- Cash

When you ask yourself the question “Where can I buy shares?” or even more specifically “Where can I buy shares in Switzerland?”, it is important to determine which investment strategy you want to pursue.

Do you want to day trade, swing trade or invest for the long term with ETFs or individual stocks (buy and hold)?

Do you plan to invest mainly in US stocks, be active in the Asian market or also invest in European stocks?

Do you plan to use options and futures sometimes? (not recommended for beginners)

Why is this important?

There is no perfect trading platform, as each provider has its own advantages and disadvantages. If you have a high transaction volume, you are better off with one broker than another, while with some brokers you also have to pay fees for inactivity, for example.

Back and forth makes pockets empty

A well-known stock market saying is that frequent back and forth (buying and selling shares) eats up profits, as fees accumulate quickly.

Degiro

Some providers shine with extremely low fees. For example, Degiro should be mentioned here, which offers unbeatably low fees, especially for investors who want to invest in US stocks.

If I now want to buy 10 Apple shares, it costs me 55 centimes. When I sell, it will cost 55 centimes again. The transaction amount does not play a role with Degiro.

A small disadvantage of Degiro is that if you have more than CHF 3000 “lying around” on your account that is not invested, the amount above the CHF 3000 is invested in the money market fund.

Since the money market fund has a negative interest rate at the moment, the uninvested money constantly loses some of its value. This is not too bad, as it only amounts to a few centimes per day, depending on the amount.

Swissquote

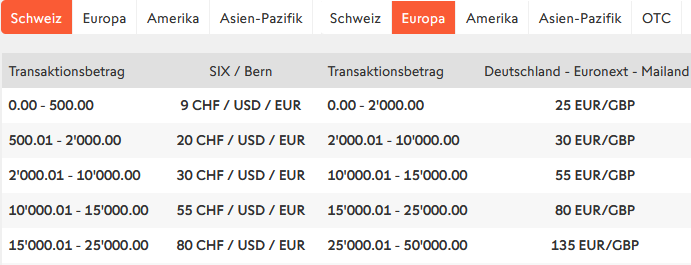

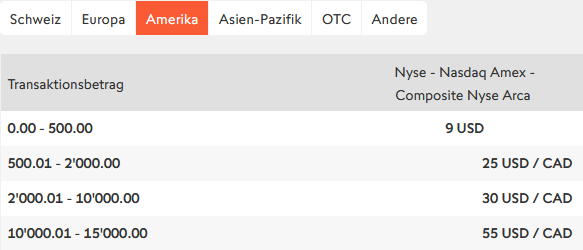

Swissquote is a Swiss online broker and very popular in this country.

With Swissquote you have no account maintenance fees and the quarterly custody account fees are limited to a maximum of CHF 50.

Swissquote also gives you the option to opt for fees based on the transaction volume or to choose the “Flat Fee Trades” offer if you generally make larger trades.

If I want to buy 10 Apple shares here, it costs me at least CHF 25.00 and CHF 25.00 again when I sell them. So you see, the saying “back and forth makes your pockets empty” has some truth to it.

Interactive Brokers

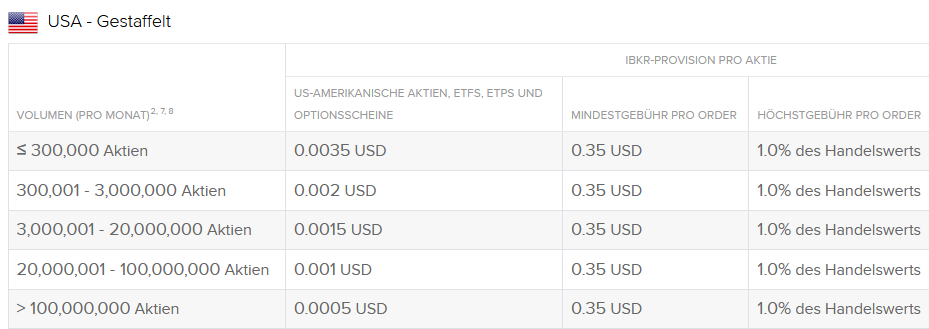

The professional platform Interactive Brokers shines with enormously low fees, even lower than Degiro.

At Interactive Brokers, you have the choice between staggered and fixed fees:

Staggered (example US equities)

Fixed price (example US shares)

Of all the platforms mentioned here, Interactive Brokers is by far the oldest and most advanced. Professional investors all over the world appreciate the platform for its diversity.

However, beginners are advised not to use this platform. The Interactive Brokers Workstation (TWS) has so many functions that a beginner is more likely to have problems with the platform than to focus on investing. The registration process alone is enormously complicated.

Furthermore, Interactive Brokers is not worthwhile for the buy and hold strategy, as IB “punishes” you for inactivity with additional fees.

Cash

The financial news site Cash.ch offers its own online broker which was even named test winner in 2021 by the SIQT (Swiss Institute for Quality Tests).

With Cash, the transaction fees are quite simple. Regardless of the transaction volume, the transaction fee is always CHF 29 if you want to buy or sell shares.

The custody fees are CHF 25 per quarter if there are less than CHF 100,000 in the account and CHF 50 per quarter if there are more than CHF 100,000 in the account.

Where can I buy shares – Conclusion

This short list contains the most popular brokers in Switzerland for anyone who wants to buy shares. It serves as a starting point and should help you to make your choice a little easier.

The choice of broker is enormously important in the long term, in order to save you the hassle of transferring your share portfolio from one broker to another, as well as high transaction fees.

Beginners should stick to Degiro, Swissquote or Cash. If you want to follow the buy-and-hold strategy and hold shares for the long term, cash is sufficient. If you want to buy and sell shares from time to time, you are better off with Degiro and Swissquote.

But beware: If you buy and sell frequently, you will quickly be classified as a professional investor by the tax authorities and have to pay capital gains tax.

Professionals and those who would like to become professionals should rather familiarise themselves with Interactive Brokers. Interactive Brokers offers you many more possibilities and access to tools that are completely missing with the competitors.

If you find it difficult to choose a broker, you can ask for a short consultation at ajooda. We will give you recommendations on the choice of broker, as well as valuable tips on how to avoid beginner’s mistakes.