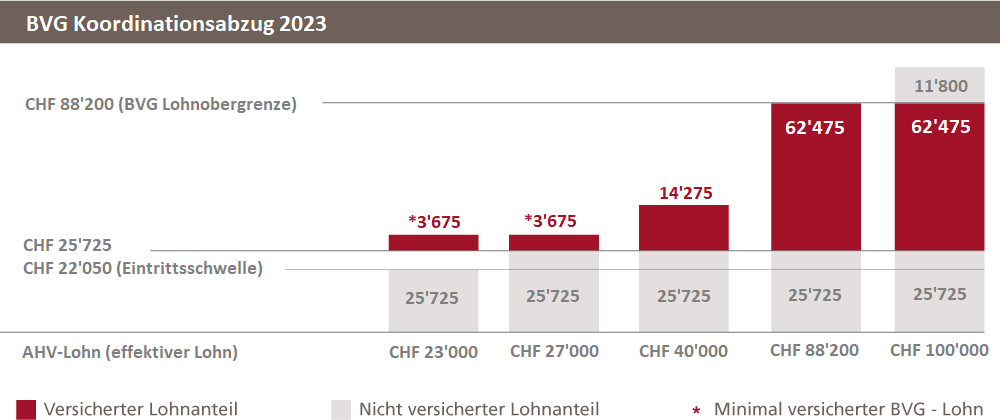

The coordination deduction 2023 is CHF 25’725 ensures that you are not insured twice.

The coordination deduction means that only contributions that have not yet been paid into the occupational pension scheme are paid into the pension fund (BVG).

It thus coordinates the pensions of the first and second pillars. The task of the first pillar (AHV) is to ensure the basic pension for the survival of the Swiss.

The second pillar (Swiss occupational pension scheme), together with the benefits of the first pillar, serves to ensure a normal standard of living in old age.

It makes a significant contribution to the financial confidence and self-determination of older people.

How high is the coordination deduction in 2023?

The coordination deduction 2023 is 7/8 of the maximum AHV pension, which currently corresponds to CHF 25’725.

The coordination deduction is deducted from the gross salary to determine the coordinated salary.

The maximum insured salary under the BVG is CHF 88’200 and the min. insured wage is CHF 3’675 as long as your gross wage reaches at least the CHF 22’050 threshold (see below).

If you earn more than this, it does not matter, because a maximum of CHF 86’040 is taken, from which the coordination deduction is subtracted.

Thus, the coordinated salary in 2023 is always a maximum of CHF 62’475, as long as you are only affiliated to the compulsory BVG, which is usually the case.

For high earners, this leads to an immense pension gap, which has fatal consequences. The accustomed lifestyle has to be drastically reduced upon retirement.

However, the problem can be solved very easily.

Coordinated salary 2023 calculation

The coordinated salary is calculated from the gross annual salary minus the coordination deduction.

Example: Mrs. Müller earns CHF 41’000 per year.

The coordinated salary is therefore CHF 15’275 because CHF 25’725 was deducted from her gross salary of CHF 41’000.

Consequently, the pension fund contributions and the resulting old-age, children’s, survivors’ and disability pensions from the pension fund are based on this salary.

What should be considered in the case of part-time employment?

Particularly important for part-time employees: The BVG entry threshold for the second pillar is CHF 22’050.

This means that if your income is less than CHF 22’050, your retirement contributions will be completely waived.

In old age, you will only receive an AHV pension of at least CHF 1’225, which is not enough to cover the subsistence minimum.

Some pension funds reduce the coordination salary for part-time employees.

Often in proportion to the workload, in order to increase the BVG contributions and thus the BVG pension.

Women often at a disadvantage

For part-time employees, which are often women, the deductions unfortunately have a negative effect.

According to the Federal Statistical Office, around 1.1 million women work part-time in Switzerland. More than 460’000 of them work 50% or less.

If, for example, a part-time employee earns CHF 50’000, the supplementary pension only guarantees the salary portion of CHF 25’000 for appropriate deductions.

This means that the savings contribution only applies to this. If the adjusted deduction is reduced to half of the aforementioned 25’000, part of the salary covered by the pension fund increases. This is CHF 37’500 instead of CHF 25’000.

AHV and pension fund = ?

The AHV pension as well as the pension from the 2nd pillar must guarantee the insured person about 60% of the last old-age salary.

This applies to the so-called BVG obligation with a maximum salary cap of CHF 88’200.

In most cases, the pension is not sufficient in old age, especially for married couples. Since the AHV pension for married couples is a maximum of CHF 3’675 instead of 2x CHF 2’450.

For many, the pension in old age is less than CHF 4’000. That is the situation today, but life is getting more and more expensive.

15 years ago you could fill your shopping cart with CHF 100. How does it look today?

Imagine what you will be able to buy in another 15 years with CHF 100. CHF 4’000 is already little today, and in a few years it will be even more limited.

In order to close the large pension gap, we recommend private pension provision with the 3rd pillar, which brings you further advantages in addition to the enormous tax savings.

So you don’t have to worry about your future and that of your family.