The allowed deductions for the tax return are almost the same in every canton. What varies enormously, however, is how high the respective deductions are allowed to be. Some cantons are very generous with deductions, while others only allow small deductions.

Below, we show you a checklist of necessary documents & the most important deductions you should be aware of.

Want to make your life easy?

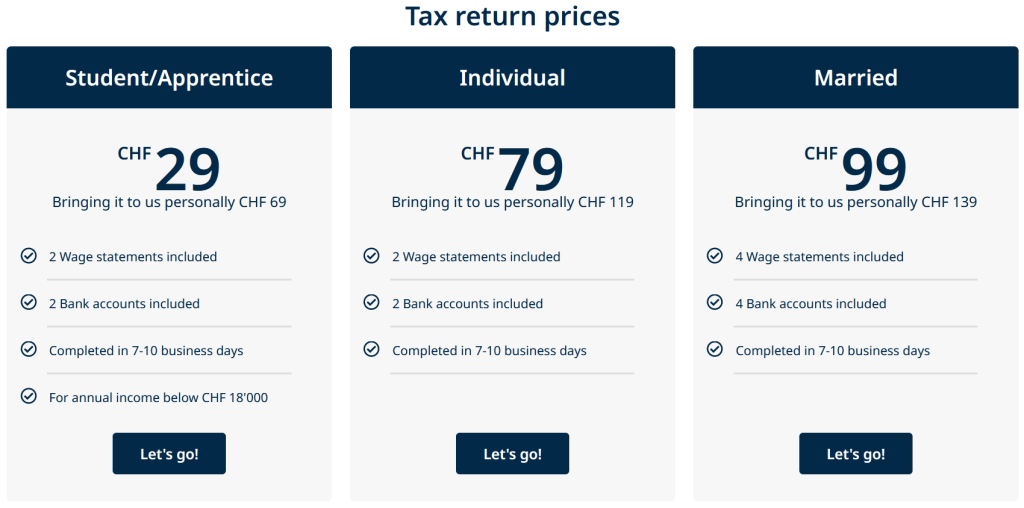

Complete your swiss tax return within just 6 minutes, with the online tax service of ajooda AG, instead of spending hours struggling through the tax software of your canton.

The maximum deductions for the tax return are automatically applied by our tax experts.

Our simple form guides you through the process: Enter relevant infos, choose number of bank accounts, stocks, real estate etc. you have, upload necessary documents, done!

Within a few days, we submit your tax return directly to the tax office – no printing or signature required. Express-Options also available!

You will then receive a copy of the tax return and the submission confirmation by e-mail. Our online tax return service is available in 21 cantons!

Over 2,000 customers throughout Switzerland trust the tax expertise of ajooda AG every year. Find out here why our customers are so satisfied and what they say about our service.

Tax return Switzerland Checklist

Mandatory

- Tax document from the tax office

- Wage statement

- Bank statements

- Cost & premium overview health insurance

Optional

- Self-paid costs (e.g. dentist)

- Receipts for contributions to pillar 3a

- Evidence of special payments into the 2nd pillar (BVG pension fund)

- Receipts for further education

- Donation receipts

- Debt certificates

- For residential property: receipts for costs (e.g. renovation work, property tax, administration costs, etc.)

Income tax in Switzerland

Income tax is levied in Switzerland on all natural individuals. The tax rate for income tax, for tax return in Switzerland, is the total income of a person. In general, all recurring, as well as all non-recurring income are subject to income tax.

As in most other countries, Swiss income tax is subject to a so-called tax progression (Steuerprogression). The higher the income of a person, the higher the tax rate applied to it.

Switzerland as a tax haven?

Despite the triple income tax burden on individuals, Switzerland is often considered a tax haven in international comparison. The reason for this is that many of the Swiss cantons and municipalities are engaged in fierce tax competition among themselves. They try to attract new and wealthy citizens from other parts of Switzerland and from abroad with low income tax rates.

The canton of Zug, where income tax rates are often in the low single-digit range, is internationally famous in this regard. The income tax burden in the larger Swiss cities such as Zurich, Basel, Bern and Geneva is above the national average for most citizens.

Special features of income tax in Switzerland

Individuals who reside in Switzerland but aren’t employed in switzerland do not pay income tax on the basis of their actual income. The calculation of income tax is based on a flat-rate estimate of the cost of living in Switzerland.

In contrast to many other countries where income tax is deducted directly from salary and paid by the employer to the relevant tax office, individuals in Switzerland are responsible for declaring their income tax themselves.

Every individual resident in Switzerland makes his or her private tax return within the first five months of a year and sends it to the tax office of his or her community of residence. The tax office then calculates the tax load for the person concerned and sends him/her an invoice for the tax to be paid.

Wealth tax in Switzerland

As mentioned above, Switzerland is a tax heaven in terms of income tax. However, when it comes to wealth tax, Switzerland does not live up to its reputation as a tax heaven. While wealth tax has been abolished in almost all European countries, it is still levied in France, Norway, Spain and Switzerland.

Wealth tax in Switzerland is regulated on a cantonal level. The majority of the cantons levy a wealth tax of 0.2 to 1.0 percent on assets over CHF 200,000.

Details on filing the tax return in Switzerland

All persons liable to tax must complete the tax return in Switzerland and submit it to the local tax office. The tax return in Switzerland can be submitted in three ways: By hand, using special tax software or online.

Deadline for filing the tax return in Switzerland

In almost all Swiss cantons and municipalities, the tax return must be submitted by 31 March of the following year. The only exceptions are the cantons of Jura and Neuchâtel (deadline until 28 February) and the cantons of Appenzell Innerrhoden and Ticino (deadline until 30 April).

Anyone who has not completed their tax return on time can request an extension of the deadline. While in the canton of Nidwalden an extension of the deadline is possible until 30.06. at most, in Schwyz and Zug you can apply until the end of the year. The cost of extending the deadline also varies from canton to canton. In most cantons an extension is free of charge. However, some cantons charge between 20 and 40 francs for it.

The 10 most important documents for the tax return in Switzerland

- Wage statement

- Bank statements

- Vouchers for securities (e.g. shares)

- Receipts for contributions to the voluntary pension plan (pillar 3a)

- Receipts for contributions to the 2nd pillar

- Medical expenses

- Summary of professional expenses

- Evidence of educational costs

- Donation receipts

- Documents concerning property tax, interest on debts, invoices for renovation work and operating and administrative costs (only for home owners)

Good preparation is half the battle. Ideally, one collects all relevant documents already during the current tax year. This saves a lot of time when compiling the tax documents later.

Deductions from income tax

Taxpayers can deduct a large number of services or payments from income tax. The following overview presents the most important deduction items:

Share purchases

The purchase of shares is often tax advantageous. If a public limited company pays dividends from capital contributions, the shareholders are not subject to tax if the company is a public limited company in Switzerland.

Dividends from foreign stock corporations are subject to withholding tax, which amounts to 30% of the dividend. However, thanks to the double taxation agreement between Switzerland and many countries, 15% can be reclaimed.

Way to work

Only costs for public transport such as bus, car and train can be deducted. However, the deduction of commuter costs is limited to CHF 3,000 per year. Anyone who travels to work by bicycle is allowed to deduct CHF 700 per year from tax.

Travel and other costs for a private vehicle (including leasing rates) cannot be deducted. Exceptions are granted to those who take significantly longer to get to work by public transport than by using their own car. In this case, the costs for the car can be deducted from tax.

Doctor and medical costs

Frequent visits to the doctor and dentist are annoying, but at least these incurred costs can be deducted from the tax. However, this only applies to those amounts that are not covered by health insurance (deductible). In most cantons it amounts to five percent of net income and if the costs for doctor’s visits are lower, unfortunately they cannot be deducted.

Education

Since 2016 there is the possibility of a tax deduction for education costs in Switzerland. Since then, you can deduct all professional training and further education costs as well as expenses for retraining from tax. However, initial training is excluded from the tax deduction. The maximum tax deduction for education costs is CHF 12,000 per year from federal tax. However, the cantons may set other maximum amounts.

Occupation-related additional costs

Every employee in Switzerland is allowed to deduct an annual flat rate for work-related additional costs from his or her tax bill – and this even without proof. For direct federal tax, the flat-rate deduction amounts to three percent of the net salary, but not more than CHF 4,000.

Application costs

Costs incurred in connection with applying for a new job, such as for copies and postage, can be deducted from tax as professional expenses. However, all costs must be able to be substantiated upon request by the tax office.

Office expenses

Costs for an office in the apartment or house can only be claimed if it is the only workplace. If the company provides another workplace, the office costs at home (including costs for internet, telephone and electricity) cannot be deducted.

Purchase of a house or apartment

The purchase of a house or apartment via a real estate loan does not necessarily have to be a tax burden. As the owner of a house or apartment in Switzerland, the so-called imputed rental value must be taxed, but the mortgage may be deducted from the assets.

Costs for private schools and tutoring

Costs for private schools, tutoring, language schools and other educational services of the children cannot be deducted from the tax. This is because the legislator already takes into account the financial burden of children on parents with the general deduction from federal and cantonal taxes.

However, there is an exception for children who have to attend a private school for school psychological reasons. Therefore, in such a case, the school costs may be claimed as disability related costs for tax purposes.

Cost of living

Contrary to widespread opinion, many of the costs that are part of the general standard of living cannot be claimed for tax purposes. In addition belong for example costs of a cleaning woman and removal costs.

Pension fund and 3a pillar (Säule 3a)

The greatest potential for reducing assets and thus lowering the tax burden is offered by purchases into the pension fund. Those who still have free assets at the end of the year can save a lot of tax, by paying as much money as possible into the pension fund.

The decisive factor for the tax deduction is always the time at which one has bought into the pension fund.

Another tax-saving tip to avoid tax progression is to have the money from several Pillar 3a accounts paid out before retirement. If you have several 3a accounts, you can have the money invested in them paid out in stages five years before retirement.

Renovations

The renovation of the house or apartment also pays off in tax terms. Costs for a new toilet, dishwasher or washing machine as well as for the laying of a new floor covering can be claimed against tax. However, one must be careful with so-called value-adding investments. The building of a winter garden or a garage is considered as value increasing and is therefore taxed.

Donations

Generosity also pays off in Switzerland in terms of taxes. Donations to church organizations and aid agencies are deductible items.

Food and drinks

Eating out can be tax deductible. People who live at least 15km from their place of work can deduct CHF 15 per day for meals.

If there is a canteen in the company, half of the costs may be deducted. Whereas in case of part-time work, the possible tax deduction of food costs depends on the working hours.

For example, if you work full-time on two days, you can deduct the cost of meals for both days. However, if you only work in the morning or afternoon, no deduction of food costs is possible.

Insurance premiums pillar 3b

Premiums for a life insurance policy are usually not tax deductible. These payments may be claimed as a general insurance deduction, but in almost all cases this deduction is already fully exhausted by the health insurance premiums.

Tax return in Switzerland – most lucrative deductions for self-employed individuals

As a self-employed person, one benefits from a number of additional tax deduction options to reduce the tax burden through deductions. The most important ones are:

Depreciation

The annual depreciation on cars, buildings, equipment or tools can be deducted.

Establishment of a stock corporation

Also the establishment of an AG is meaningful for self-employed people for tax reasons. Starting from a share portion of ten per cent one gets a tax discount on dividend payments of the corporation. Depending on the canton, the rebate is between 30 and 65 percent.

Business expenses

Business expenses such as restaurant meals, invitations and travel can be tax deductible. Generosity towards customers and employees pays off.

Ecological investments

Investments to improve the ecological balance sheet also pay off. If, for example, you save energy thanks to an investment, you can claim 50 percent of it as tax deductible in the first two years.