How much pension will I receive and what is the maximum AHV pension?

The maximum AHV pension for individuals in 2021 is CHF 2,390 per month and CHF 28,680 per year.

You can only claim this maximum AHV pension if you have paid into the scheme for 44 contribution years and have an average AHV income of CHF 86,040.

If you miss contribution years due to a late move to Switzerland, unemployment where you were no longer entitled to unemployment benefits (retired) or stays abroad, your pension will be reduced by 2.27% for each missing contribution year.

AHV pension calculation

It is also logical that not everyone can have an average AHV of CHF 86,040. Accordingly, the AHV pension is reduced according to the AHV pension table (scale 44).

Those who had few AHV deductions or made few AHV contributions due to low wages and have an average income of less than CHF 14,340.- without a contribution gap receive a minimum AHV pension of CHF 1,195.- per month.

The corresponding education and care credits are still added to the annual income.

This is mainly so that the spouse who had to stay at home because of the children does not miss out.

Nevertheless, most of them do not even get close to the maximum AHV pension.

In addition, many housewives and part-time employees will also receive a very low or no BVG pension due to their low workload.

How much pension do married couples receive?

The AHV pension for cohabiting couples is a maximum of CHF 4,780 per month if both partners are entitled to a maximum pension.

However, the AHV pension for married couples is only a maximum of 150% of the maximum AHV individual pension of CHF 2,390.-, i.e. a maximum of CHF 3,585.-.

If the sum of the two pensions exceeds the limit, the pension is reduced accordingly.

The retirement pension of the first spouse is calculated on the basis of the average annual salary and credits.

If the second spouse retires, the income during the marriage period is divided. That is, half is credited to the couple.

Since earned income is often unequally distributed between men and women, many pensioners receive a maximum personal pension until their wives retire.

On the other hand, female pensioners usually receive only a minimum AHV pension until their husband retires.

What happens to my spouse’s pension when I am no longer around?

When one of the spouses dies, the AHV pension is recalculated.

The surviving partner receives the old-age pension as a single person, but the widow’s or widower’s supplement is 20%.

Nevertheless, widows and widowers with this supplement receive a monthly pension of up to CHF 2,390.

A widow who also qualifies for a survivor’s pension receives the higher amount of the two pensions.

Am I entitled to supplementary benefits?

If the pension is not sufficient to live on, you are entitled to AHV supplementary benefits.

Supplementary benefits come in 2 forms:

- Money for insufficient income

- Sickness- & disability-related expenses are paid for

Am I entitled to helplessness allowance?

Yes, as long as the pensioner is demonstrably in need of care, he or she is entitled to AHV helplessness allowance of CHF 239 to CHF 956 per month, depending on the degree of severity.

The AHV helplessness allowance should not be confused with the IV helplessness allowance. Different contributions apply there.

Do I have to register for my AHV pension myself?

Your pension does not come automatically when you reach normal retirement age!

To ensure that your first pension is paid out on time, you must register your AHV retirement pension with the AHV compensation office.

It is best to register your AHV pension 6 months before you retire.

Can I close contribution gaps?

The total contribution period is 44 years for men and 43 years for women.

The gap occurs, for example, if someone does not always work in Switzerland or does not pay the minimum AHV contribution at least during the academic year.

Owing AHV contributions can be paid in retroactively for a maximum of 5 years. The minimum AHV contribution for 2021 is CHF 503 per year.

You can also close your contribution gap with your youth years. What are youth years?

If you have paid AHV contributions from the age of 18-21, e.g. if you were an apprentice, you can have these years credited to close gaps.

Is an early withdrawal of the AHV pension worthwhile?

The AHV pension can be drawn one to two years before the normal retirement age.

However, the pension is reduced by 6.8% per year of early withdrawal, up to a maximum of 13.6%.

It is up to you to decide whether you want to or can do without this part of your pension.

Depending on your state of health and life expectancy, it may still be worthwhile to retire earlier and enjoy your retirement.

Postponing AHV retirement – What advantages does this give me?

If you are still fit and want to or can continue working, you can of course defer your AHV pension.

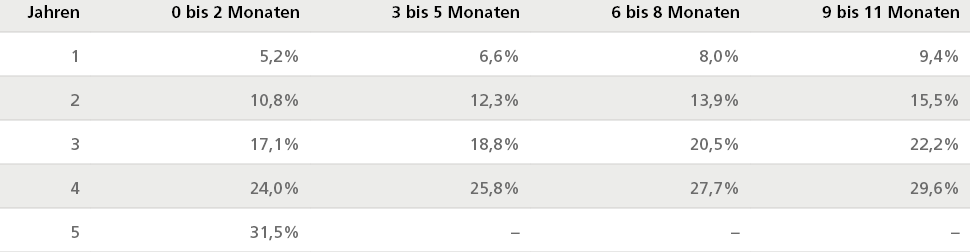

The deferral must be at least 12 months and may not exceed 5 years.

Depending on the deferral, the pension increases accordingly:

Do I still have to pay AHV contributions if I retire early?

Yes, because the obligation to pay AHV contributions applies until the normal retirement age. 65 years for men and 64 years for women.

The amount of AHV contributions is calculated as follows:

Annual pension income x 20 + net assets.

If the sum of these is less than CHF 300,000, then only the minimum AHV contribution of CHF 503 per year must be paid.

The maximum AHV contribution is CHF 25,150 and would only have to be paid if the sum above exceeds 8 million.

I receive an AHV pension and work part-time. Do I still have to pay AHV contributions?

Yes, contributions for AHV, IV and EO still have to be paid. However, the contribution for ALV does not apply.

However, an allowance of CHF 1,400 per month applies. This means that if you earn less, you do not have to make any AHV deductions.

If you earn more, you only have to make AHV deductions on the amount that exceeds the monthly tax-free amount.