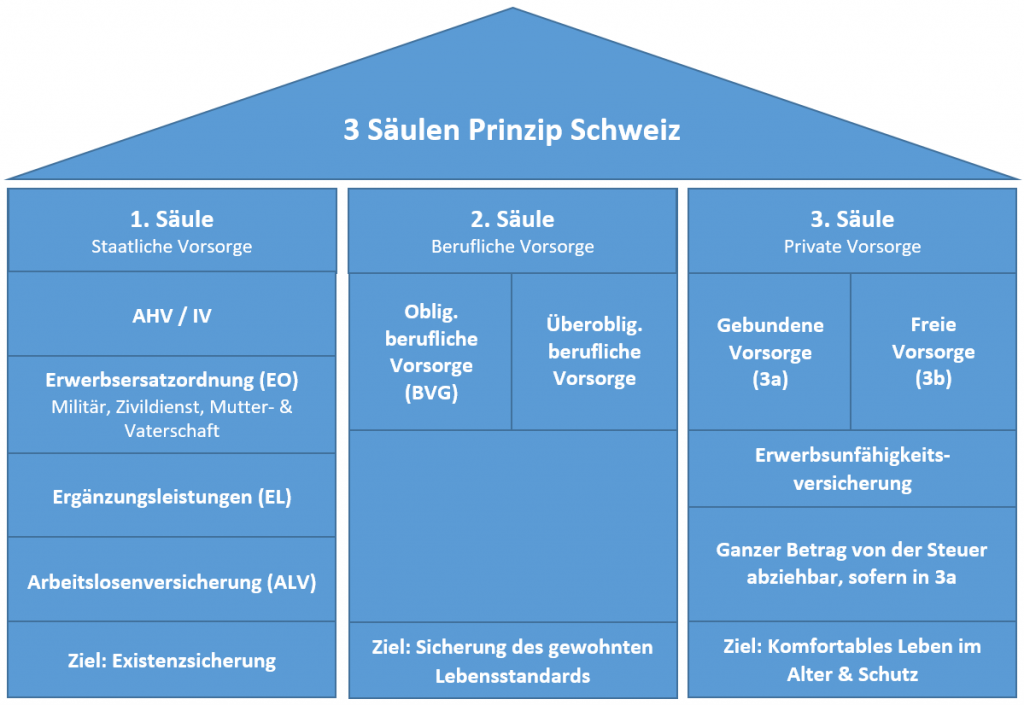

The occupational pension (pension fund) of the 2nd pillar

What is occupational pension?

The occupational benefit scheme is part of the 2nd pillar in Switzerland and has the purpose of minimising the consequences of the following risk factors:

- Economic consequences of old age (BVG)

- Economic consequences of death (UVG, BVG)

- Economic consequences of disability (UVG, BVG)

The second pillar aims to ensure a reasonably comfortable life for the insured.

As a rule, the pension from the 1st and 2nd pillars together corresponds to about 60% of the previously earned income.

Who is compulsorily insured in the occupational pension (pension fund)?

Anyone who earns a compulsory AHV income of at least CHF 22,050 per employer is insured under the BVG.

Unemployed persons who receive daily allowances from unemployment insurance (ALV) are also BVG insured. However, unemployed persons are only insured against disability and death under the BVG. No BVG savings contributions are paid.

The contributions of ALV recipients are not paid into the pension fund but into the BVG supplementary institution.

For self-employed persons, occupational pension provision is voluntary.

Since this is usually not the case, self-employed persons should definitely take out a 3rd pillar pension and make provisions so that they are not left with nothing in the event of an accident or illness.

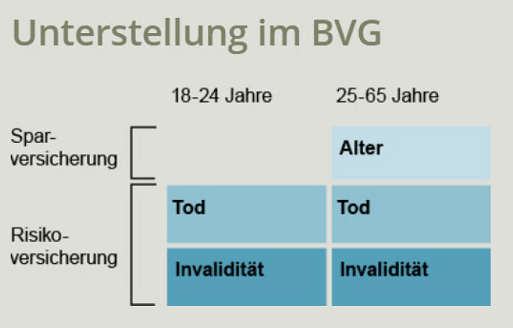

From the year of your 18th birthday, you are insured, but only against the risks of disability and death.

Only from the age of 25 do you accumulate savings capital.

It is therefore quite normal that at the age of 25, much more contributions are suddenly due for occupational pension provision.

How high are BVG contributions 2023 for the pension fund?

The BVG savings contributions for occupational pension provision are as follows (as a percentage of salary):

| 25 – 35 years | 7% BVG savings contribution |

| 35 – 45 years | 10% BVG savings contribution |

| 45 – 55 years | 15% BVG savings contribution |

| 55 – 65 years | 18% BVG savings contribution |

The employer must pay at least 50% of those contributions, some employer pay more to attract talent. But 50/50 is the norm.

So if the contribution for a 28 year old is 7% in total, the employer would pay 3.5% and the employee would pay the rest.

Since the regular retirement age for women is 64, they do not have the last 18% for occupational benefits.

Who is not insured under the BVG?

You do not have to pay occupational benefit contributions if the following situations apply:

- Temporary employment (less than 3 months).

- Secondary employment, if you are already insured under the BVG in your main job.

- IV pensioner with an IV degree of 70%+ and still gainfully employed.

What is the BVG minimum wage in 2023?

The BVG minimum wage in 2023 is CHF 22’050 per year. This is also called the BVG entry threshold.

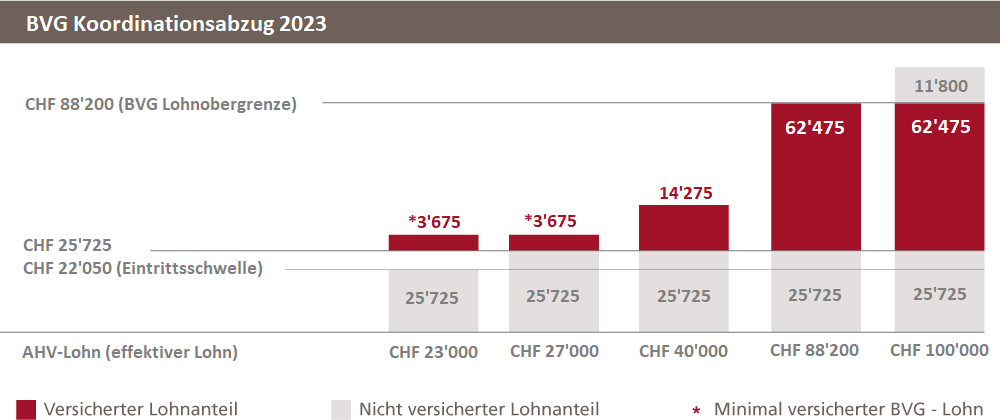

What is the insured salary 2023 in the pension fund?

The insured salary for the occupational benefit scheme 2023 is a maximum of CHF 60,945.

It does not matter whether you earn CHF 90’000 or CHF 300’000 per year, the maximum BVG-insured salary remains the same (unless you are affiliated to the supplementary occupational benefit scheme).

Therefore a good performing 3rd Pillar can help.

If you earn little so that after the BVG coordination deduction of CHF 25’725 a minus arises, the minimum BVG insured salary 2023 is always at least CHF 3’675.

BVG insured salary 2023 Example (Koordinationsabzug)

BVG Compulsory vs Non-Compulsory Occupational Pension Plans

BVG Compulsory

The BVG maximum salary is CHF 88’200 (as of 2023).

However, the coordination deduction of CHF 25’725 must be deducted from this, resulting in a coordinated or maximum insured salary of CHF 62’475

The BVG requires that the employer pays at least 50% of the BVG contribution. Some employers even pay more out of goodwill.

The BVG obligation is bound to very clear requirements. For example, the pension funds cannot invest the money as they wish, but must invest part of it in bonds.

Also, the BVG conversion rate in 2023 is currently still 6.8%.

Since 2017, the minimum interest rate at which the BVG capital earns interest has been 1.0%.

By comparison: from 1985 to 2002, this minimum interest rate was still 4.0%!

Non-mandatory occupational benefit scheme

The extra-mandatory occupational benefit scheme is intended for high earners so that the pension gap is not too large.

The maximum insured salary in the supplementary occupational benefit scheme is CHF 882’000 per year.

The BVG extra-mandatory pension plan is not bound to any specifications. In other words, each pension fund is free to determine the conversion rates. However, these are usually lower than the 6.8%.

BVG superobligation advantages

- Extension of the IV pension

- Extension of survivors’ benefits

- Extension of beneficiaries (e.g. cohabiting partners)

What is the BVG conversion rate 2023?

The BVG conversion rate for 2023 is 6.8%. However, this will soon be corrected downwards due to reforms.

When is the pension fund payment possible?

You can have your pension fund paid out in the following situations:

- Emigration

- Emigration outside the EU -> Pension fund payout possible

- Emigrating within the EU -> Must park capital in a BVG catch-up fund until retirement

- Self-employment

- Small amount (amount less than 1 annual contribution)

- Home ownership promotion

- Only owner-occupied property. No holiday or investment property

- Up to 50 years, entire capital may be used. After that only limited.

When is early retirement possible?

The pension fund can provide for early retirement in the regulations. The earliest possible retirement age is 58.

Can I have the pension fund pay out in the form of a lump sum or do I have to take the pension fund annuity?

If you withdraw a lump sum from the pension fund, you can withdraw part of it as a lump sum and the rest as a pension.

If you want to take a lump sum from the pension fund, this amount must be at least 25% of the total capital.

Disability pension fund

The BVG disability pension is based on the degree of disability, just like the AHV. This means that a different IV pension is paid depending on the degree of disability.

IV degrees in Switzerland

The degree of disability is divided into the following 5 levels:

| 0 – 39% IV degree | No pension |

| 40 – 49% IV degree | One quarter pension |

| 50 – 59% IV degree | Half pension |

| 60 – 69% IV degree | Three quarter pension |

| 70%+ IV degree | Full pension |

Survivors’ benefits pension fund

For survivors’ benefits under the BVG, men and women are treated equally, i.e. the same conditions apply.

In the case of survivors’ benefits from the AHV, however, women are better off.

| 60% widow’s pension 60% widower’s pension | – Min. 1 child – Older than 45 years and at least 5 years of marriage – Condition not fulfilled? -> Lump-sum settlement amounting to max. 3 years’ widow’s pension |

| 20% orphan’s pension | – Up to 18 or 25 years of age – Surviving partner receives orphan’s pension, not the child. |

As you can see, the swiss pension fund (Pensionskasse) is an important part of the 3 Pillar system in switzerland, but it has it’s limitations.

For those that desire to live a certain life standard after pension age, no matter if they want to stay in switzerland or move abroad, it is always wise to check the possibilites for improving their tax- and savings situation.

Our Pension and 3rd Pillar experts, will gladly assist you in crafting an individual plan, that gets the very best out of your situation. Get in touch with us!