Buying stocks in Switzerland – An Overview

Worldwide, access to the stock markets has become much easier for private investors in recent years. In the USA in particular, the market for non-institutional investors is booming.

In Switzerland, too, more and more providers are stepping forward to make it easier for clients to buy stocks in companies.

This competition is great for you as a client, as it lowers the prices for account management and trading fees considerably.

Buying stocks in Switzerland – What you need to bear in mind as an investor

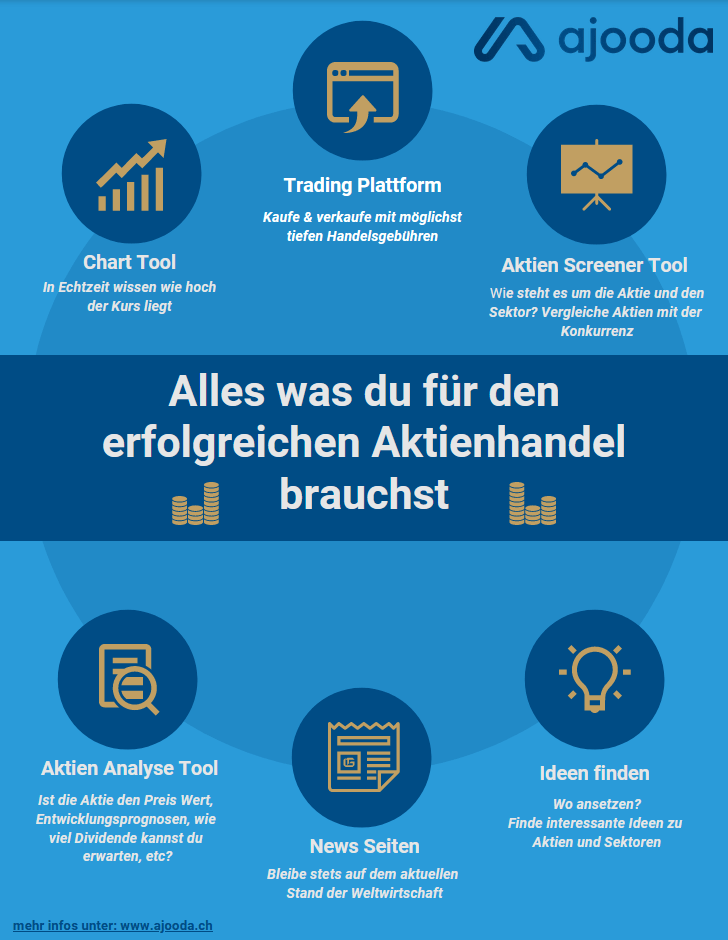

Buying stocks in Switzerland – Which tools should I use as an investor?

So that you don’t buy stocks blindly and follow every trend or hype, it is worth investing in a few tools that will significantly increase your chances of winning.

Even if you want to invest in ETFs, you need information.

Except maybe if you want to invest in the MSCI World ETF, Gold ETF or set up a Swiss ETF savings plan to take care of as little as possible.

But especially if you want to buy and hold stocks for the long term or do day trading in Switzerland, you need information to avoid making a mistake.

The tools are usually cheap and can save you from losses of several thousand francs, as they often show you the health of a company and positive or negative development potential.

Here you will find the best stock tools for investors, which we as well as other experienced investors use worldwide.

Trading Platform Switzerland – Which one should I use?

The choice of trading platform has a big impact on your success in the long run. Why?

Especially if you want to buy and sell a lot of stocks, sooner or later the transaction fees will eat up your share profits.

Therefore, it is very important to choose a good trading platform in Switzerland right from the start, so that you don’t have to move your portfolio to a new trading platform later on.

In our article on the best trading platform in Switzerland, you will find the 4 best-known and best trading platforms for stocks in Switzerland.

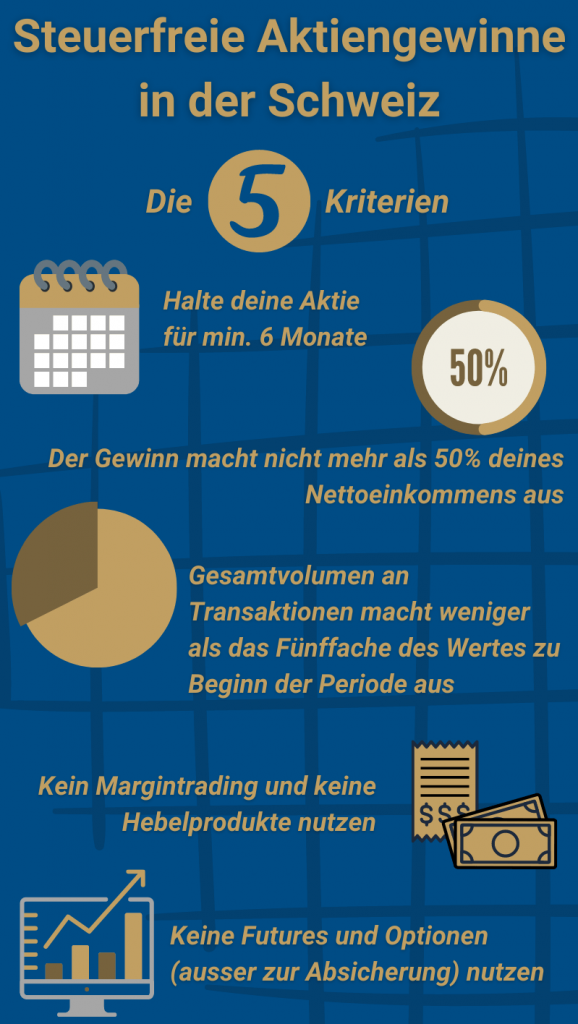

Buying stocks in Switzerland – Do I have to pay tax on share gains?

If you ask yourself “Do shares and capital gains get taxed?”, the answer is not always obvious.

There are mainly 3 types of stock taxes:

- Capital gains tax

- Withholding tax on dividends

- Withholding tax

Capital gains are not always tax-free. If you buy stocks and sell them at a profit, you have to pay tax on these gains in Switzerland.

However, there is a way to avoid paying tax on share gains.

To do this, it is important that you are not classified by the tax authorities as a professional investor in Switzerland.

How do I avoid the status as a professional investor in Switzerland?

Nevertheless, you have to declare your shares in your tax return. More information on this can be found in our article on capital gains tax.

In addition to capital gains tax, there is also withholding tax on dividends in Switzerland from foreign shares.

Last but not least, there is the withholding tax, which can be considered as a backup tax. Why is this?

The withholding tax is 35% and is automatically deducted as security. In order to get it back, you have to declare your share positions when filling in your tax return. This prevents tax evasion.

Note: In connection with buying stocks in Switzerland, there is still stamp duty. However, this is only levied if you use a Swiss trading platform such as Swissquote. There is no stamp duty at DEGIRO.